south dakota sales tax rates by county

For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. Our dataset includes all local sales tax jurisdictions in South Dakota at state county city and district levels.

How Do State And Local Individual Income Taxes Work Tax Policy Center

The total sales tax rate in any given location can be broken down into state county city and special district rates.

. The 2018 United States Supreme Court decision in South Dakota v. Some cities and local governments in Day County collect additional local sales taxes which can be as high as 3. The South Dakota state sales tax rate is currently.

There are a total of 289 local tax jurisdictions across the state collecting an average local tax of 1817. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city. Enter a street address and zip code or street address and city name into the provided spaces.

A sample of the 385 South Dakota state sales tax rates in our database is provided below. Searching for a sales tax rates based on zip codes alone will not work. The South Dakota state sales tax rate is currently.

The minimum combined 2021 sales tax rate for Turner County South Dakota is. The South Dakota state sales tax rate is currently. The South Dakota Department of Revenue administers these taxes.

Has impacted many state nexus laws and sales tax collection requirements. The Hughes County sales tax rate is. What is the sales tax rate in Hughes County.

Heres how Day Countys maximum sales tax rate of 75 compares to other counties around the United States. Click Search for Tax Rate. 366 rows South Dakota Sales Tax.

To review the rules in South Dakota visit our state-by-state guide. Look up 2022 sales tax rates for Deuel County South Dakota. The South Dakota State Sales Tax is collected by the merchant on all.

The Lake County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v. 450 Is this data incorrect Download all South Dakota sales tax rates by zip code.

South Dakota has a 45 sales tax and Pennington County collects an additional NA so the minimum sales tax rate in Pennington County is 45 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in. The minimum combined 2022 sales tax rate for Pennington County South Dakota is. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The 2018 United States Supreme Court decision in South Dakota v. Free sales tax calculator tool to estimate total amounts. The minimum combined 2022 sales tax rate for Lake County South Dakota is.

This is the total of state and county sales tax rates. Average Sales Tax With Local. South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales.

Find your South Dakota combined state and local tax rate. Sales and use tax Retail ecommerce manufacturing software Consumer use tax. This is the total of state and county sales tax rates.

This is the total of state and county sales tax rates. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. The 2018 United States Supreme Court decision in South Dakota v.

The Turner County sales tax rate is. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. Has impacted many state nexus laws and sales.

The state sales and use tax rate is 45. The tax data is broken down by zip code and additional locality information location population etc is also included. Higher maximum sales tax than any other South Dakota counties.

Look up 2022 sales tax rates for Deuel County South Dakota. The South Dakota state sales tax rate is currently. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

Municipalities may impose a general municipal sales tax rate of up to 2. The base state sales tax rate in South Dakota is 45. South Dakota has a 45 sales tax and Lake County collects an additional NA so the minimum sales tax rate in Lake County is 45 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Lake County.

What is the sales tax rate in Pennington County. This is the total of state and county sales tax rates. The South Dakota sales tax of 45 applies countywide.

For additional information on sales tax please refer to our Sales Tax Guide PDF. The Brown County sales tax rate is. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

The South Dakota state sales tax rate is currently. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Tax rates provided by Avalara are updated monthly.

The 2018 United States Supreme Court. 31 rows The latest sales tax rates for cities in South Dakota SD state. The South Dakota State South Dakota sales tax is 450 consisting of 450 South Dakota state sales tax and 000 South Dakota State local sales taxesThe local sales tax consists of.

The minimum combined 2022 sales tax rate for Hughes County South Dakota is. The Pennington County sales tax rate is. Click on any county for detailed sales tax rates or see a full list of South Dakota counties here.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Iowa Sales Tax Small Business Guide Truic

Income Tax Filings In These Counties Were Audited At A Lower Rate Than The Nation As A Whole Infographic Map Places In America Native American Reservation

How Do State And Local Corporate Income Taxes Work Tax Policy Center

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

Rv Living How To Make It Without A House

State Corporate Income Tax Rates And Brackets Tax Foundation

These 7 U S States Have No Income Tax The Motley Fool

States With Highest And Lowest Sales Tax Rates

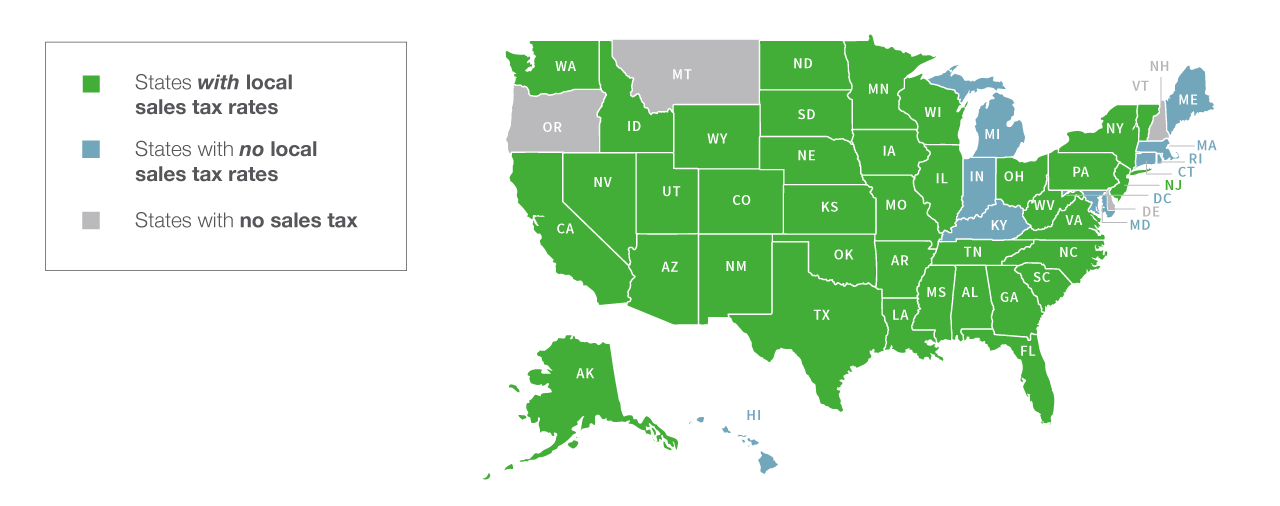

How Do State And Local Sales Taxes Work Tax Policy Center

Property Taxes By State In 2022 A Complete Rundown

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Sales Tax Expert Consultants Sales Tax Rates By State State And Local Rates

State Sales Tax Rates And Combined Average City And County Rates Download Table

State Corporate Income Tax Rates And Brackets Tax Foundation